How We Help You

Most new clients come to us because of a personal or professional referral, which is the greatest compliment of trust that we can receive. Our clients see us as their long-term financial partner and sounding board, and we guide them through life’s money decisions both big and small. We offer services you may already expect a financial advisor to take care of, like estate planning, RSPs, debt management, and more. What many don’t know, though, is that we can also help you answer questions like these:

What terms should you look for in a mortgage? What is reasonable in the marketplace right now?

Should you buy or lease a vehicle? If you’re self-employed or a business owner, should this be done personally or through the business?

Which spouse should opt for CPP & OAS benefits early and which should defer, if at all?

How do you assess if taking any of the various monthly payment options for your Group RRSP and/or pension plans is better for your personal circumstance than taking a lump sum payment?

If you leave an employer and have group health benefits, a group RSP or pension, what options do you have with them when your employment ends?

Why Professional Advice Matters

Relying on professionals to guide your financial decisions can make you more confident and better informed. You’ll also likely achieve greater prosperity throughout your life. We can say this, because it’s what our own clients have experienced and what industry research also shows.

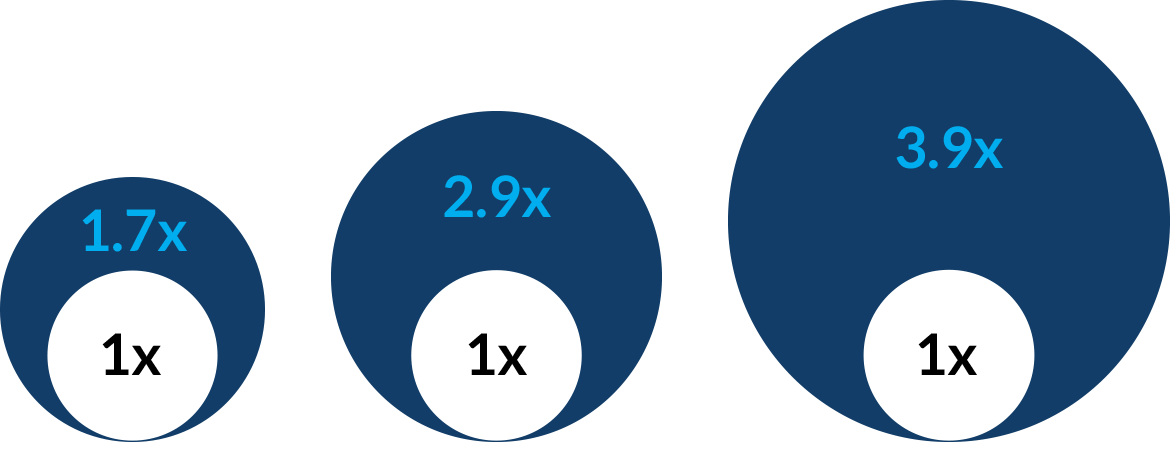

Research has continually pointed to the measurable value that financial advisors and the guidance they provide their clients, and it has found that those who work with financial advisors save at nearly twice the rate than those who don’t and accumulate on average 3.9 times more assets after 15 years than those who go it alone.

(source Montmarquette, C., & Viennot-Briot, N. (2016). The Gamma Factor and the Value of Financial Advice. CIRANO.)

Investors who work with an advisor Accumulate 3.9x More Assets than those who don’t.

GROWTH IN ASSETS

By working together with us, you’ll have a better chance of:

- Accumulating greater wealth through better saving behaviour

- Building assets for a more comfortable retirement

- Ensuring that the assets you have are as tax efficient as possible

- Maintaining long-term strategies while accommodating the realities of daily life

- Protecting against poor financial decisions

- Avoiding emotional financial habits

Regardless of your stage of life or amount of wealth, you can benefit from professional financial advice, and we’re here to help, because your financial success is our success.

We promise to work with you and help your money do the right things, at the right time, for the right reasons. We’ll help you define and set realistic goals and deliver integrated financial advice through every stage and milestone of your life.

The Steps We Take to Help You

We help you connect your money, build your wealth, and protect your future. We’ll welcome you with a no-cost, no-obligation, ‘let’s get to know each other’ meeting where we’ll take the time to listen carefully, learn about your life and where you are today and where you see yourself in the future. We’ll also give you the opportunity to ask us questions and share some of our own ideas about where we think we can help so you can get to know us better. From here, we can decide if it makes sense to take the next steps towards building a long-term relationship.

What to Do Next

Still deciding? Fill out this self-assessment. It’ll only take five minutes, and it’ll show you the different areas where we can help guide you.

Or, if you’d rather talk to a person, call or email us. There’s no cost or obligation; that’s simply not how we operate. We’ll listen to your questions and concerns and learn about your life and the role your finances play in it. We’ll then let you know where and how we can help.

1

1

2

2

3

3

4

4